how much taxes will i owe for doordash

If you made 5000 in Q1 you should send in a Q1. For 2020 if you make more than 600 in self-employment income you have to file a tax return.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Just make sure that theyre not already being reimbursed to you by Doordash.

. A 1099 form differs from a W-2 which is the standard form issued to. End Your IRS Tax Problems - Free Consult. It doesnt apply only to DoorDash.

100 of prior year taxes. End Your IRS Tax Problems - Free Consult. Toll fees that you pay while you drive for Doordash are tax-deductible.

Answer 1 of 5. Im only paying 900 in. Answer 1 of 2.

Between my mileage deduction and other deductions for hot bags cell phone bill new work phone title and registration fees Etc my deductions are 187610. How much can you make on DoorDash without paying taxes. A 1099-NEC form summarizes Dashers earnings as independent.

Free Case Review Begin Online. If you earned more than 600 while working for DoorDash you are required to pay taxes. How Do Taxes Work with DoorDash.

All earnings are not tax withheld from doordash so as youre working youll have to calculate how much you owe in taxes. Youll receive a 1099-NEC if youve earned at least 600. Ad BBB Accredited A Rating.

Ad Based On Circumstances You May Already Qualify For Tax Relief. In this video I will break down how you can file your taxes as a doordash driver and also what you can write-off and how you can calculate how much money you. Taxes apply to orders based on local regulations.

Also the government can go fuck itself. Not very much after deductions. Yes - Just like everyone else youll need to pay taxes.

The type of item purchased. The amount of tax charged depends on many factors including the following. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

Ad BBB Accredited A Rating. The forms are filed with the US. I made about 7000 and paid maybe 200 in taxes after all the deductions.

How are Taxes Calculated. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. Are a united states citizen or permanent resident.

Doordash taxes Taxes Tade Anzalone January 18 2022. The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year. 90 of current year taxes.

Dashers will not have their income withheld by the. That is all EDIT. The Federal Tax ID Number or Employer.

You can deduct expenses from that income such as mileage uniforms. 110 of prior year taxes. Collect and fill out relevant tax forms.

That would make my. AGI over 150000 75000 if married filing separate 100 of current year taxes. See If You Qualify For IRS Fresh Start Program.

To file taxes as a DoorDash driver aka. Internal Revenue Service IRS and if required state tax departments. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

The self-employment tax is your Medicare and Social Security tax which totals 1530. There are various forms youll need to file your taxes. All income you earn from any source must be reported to the IRS and your states Department of Revenue.

Each year tax season kicks off with tax forms that show all the important information from the previous year. Instead you need to keep track of how much you owe based on what youve earned working with Doordash. All you need to do is track your mileage for taxes.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Filing Independent Contractor Taxes For Food Delivery Drivers Tax Help Tax Write Offs Doordash

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

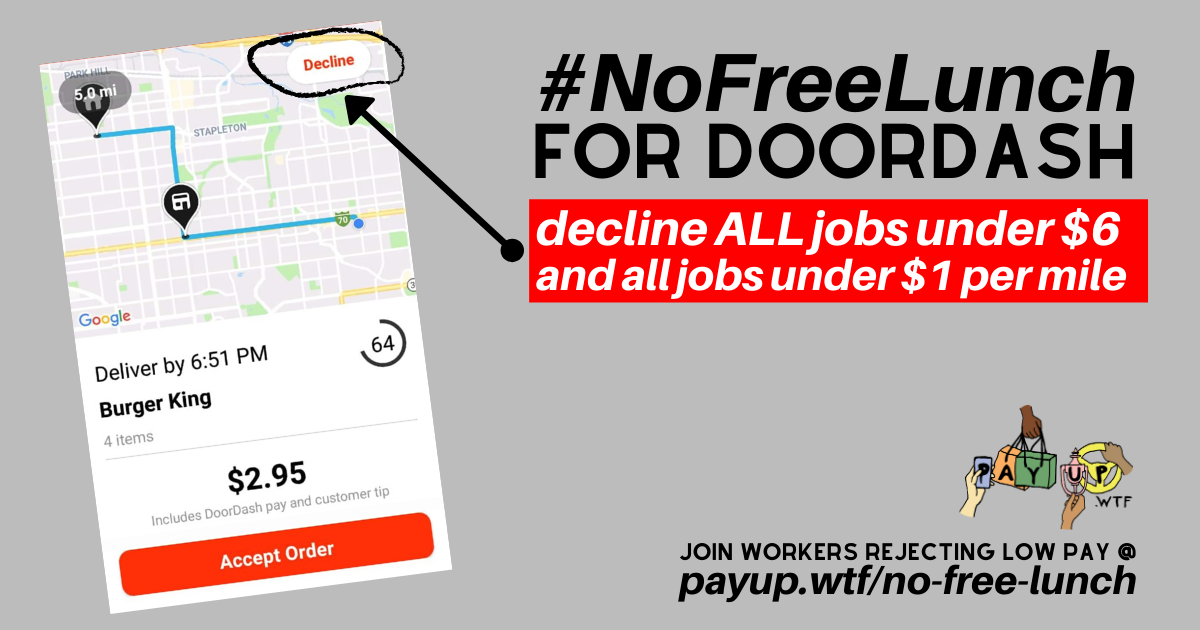

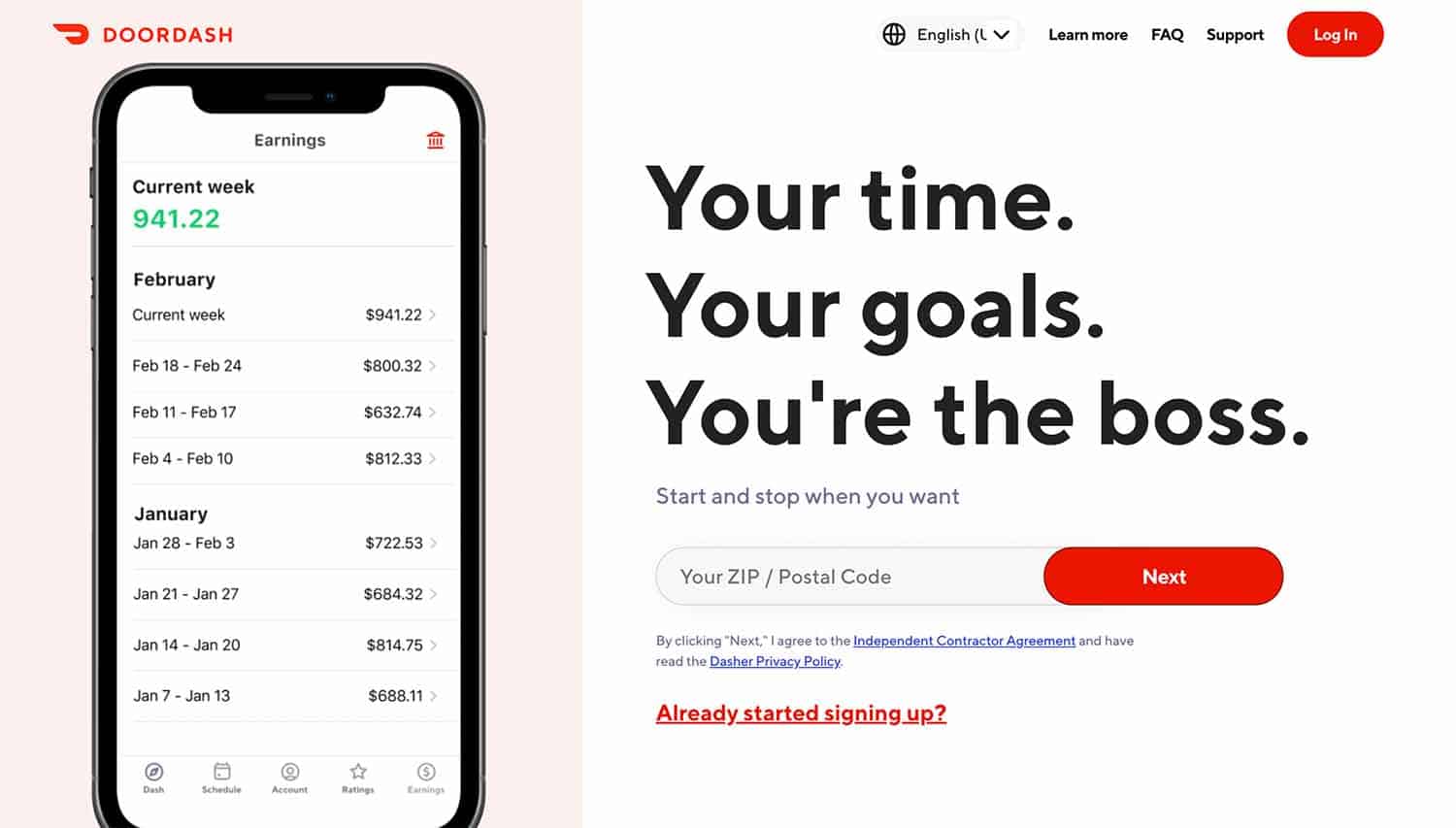

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

You Can Make Decent Money On Doordash In 2022 You Just Need To Know How Use These Tricks From Top Earning Dashers To Level Up In 2022 Tax Help Filing Taxes Doordash

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Much Money Can You Make With Doordash Small Business Trends Business Tax Deductions Improve Your Credit Score

Delivering For Grubhub Vs Uber Eats Vs Doordash Vs Postmates Youtube Postmates Doordash Uber

Updated Doordash Top Dasher Requirement Note That Popped Up In The Dasher App Promising Top Dasher Will Now Give You Priority In 2022 Doordash Opportunity Cost Dasher

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Federal Income Tax Tax Income Tax

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Insurance Car Insurance